tax unemployment refund status

View Refund Demand Status Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. Unemployment benefits must be reported on your federal tax return as a part of your income.

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

IR-2021-159 July 28 2021 WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it.

. Millions of taxpayers who collected unemployment last year might be eligible to receive an additional refund from the Internal. Of that number approximately 4 million taxpayers are expected to receive a. TAX SEASON 2021.

The IRS uses the FUTA recertification process to make sure the total taxable wages you claimed on the Employers Annual Federal Unemployment FUTA Tax Return Form 940 or the federal. IRS sending unemployment tax refund checks For most states you will receive Form 1099-G in the mail from your state unemployment office. If none leave blank.

IRS unemployment refund update. Numbers in Mailing Address Up to 6 numbers. The IRS has sent 87 million unemployment compensation refunds so far.

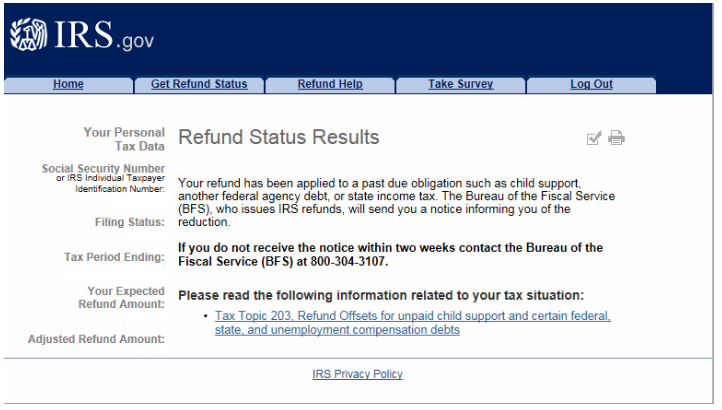

Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. How to track and check its state The tax authority is in the process of sending out tax rebates to over 10 million. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

Find out how you can obtain. If your mailing address is 1234 Main Street the numbers are 1234. The first round of payments are expected between.

Check Your 2021 Refund Status. By Christopher Zara 1 minute Read. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund.

Form 1099G tax information is available for up to five years through UI Online. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment. The Internal Revenue Service doesnt have a separate portal for checking.

Viewing your IRS account. If an adjustment was made to your Form 1099G it will not be available online. How long it normally takes to receive a refund.

Numbers in your mailing address. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next. For this round the IRS identified approximately 46 million taxpayers who may be due an adjustment.

Your exact refund amount. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. In addition if your unemployment benefits are taxable in the state where they are.

The Internal Revenue Service doesnt have a separate portal. Using the IRS Wheres My Refund tool. If you see a 0.

You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your. Californians who received a Golden State Stimulus check in 2021 via direct deposit will be the first to receive the tax refund. Social Security Number 9 numbers no dashes.

Go to My Account and click on.

Tax Topic 203 Refund Offset Where S My Refund Tax News Information

I Filed My Taxes When Can I Expect My Tax Refund

1099 G Unemployment Compensation 1099g

Interesting Update On The Unemployment Refund R Irs

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Just Got My Unemployment Tax Refund R Irs

Where S My Refund Track My Income Tax Refund Status H R Block

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Where S My Refund How To Track Your Tax Refund Statuswhere S My Refund How To Track Your Tax Refund Status Kiplinger

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

10 200 Unemployment Refund When You Will Get It If You Filed Taxes Early

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting